Getting out of debt is not easy. However, it is possible if you follow some realistic ways to reduce debt and live a debt free life.

You should understand that you can help yourself in getting credit card debt relief. Put some effort in and see better financial results.

Here are the best 8 ways to reduce debt on your own.

Here are eight ways in which you can help yourself reduce debt:

1. Do Not Increase Your Debt

The only shortcut to avoid increasing your debt is to cut up your credit cards. Yes, this is true.

If your credit cards are useless, you will not use them even if you want to use them. Once you form the habit of using your cash rather than a credit card, life will be easier.

This is because you will not have to repay the amount of money with extra interest. Eventually, you will be able to save more.

2. Write Down What You Spend

Most people find this financial advice quite annoying. However, this is a VERY important step for you to complete. By following this, you can get out of debt on your own easily.

Keep a diary with you and write down what you have spent on the same day. Even if you just went shopping, write the total amount of money you spent on it.

After a week, take a good look at your list. Did you really need to spend that money? By keeping the list, you will know whether spending on particular shopping items was essential or not.

3. Categorize Your Expenditures

Categorizing things helps solve a lot of problems. In order to get debt relief, divide all your expenses in categories.

These categories can be “Must haves” (rent, food, medicine, etc),“Should haves” (new dresses to wear for work, membership expenses for gym,etc), and “Like to have” (cable TV, magazine subscriptions, lunch with friends,etc).

4. Make a Budget

At the start of each month, plan what you have to spend throughout the month. Make a budget, but make sure you spend according to it.

You can do this by comparing your last month’s expenses and writing this month’s expected spending. If there is any room to repay some of your debt, then you can also include this in your budget.

5. Know Your Repayment Amount

When you look at your budget for the month, you can analyze which expenses you can cut back easily. For instance, if you have a magazine subscription, then cancel it so that you can use that money to repay your debt. And…just go to the library and spend an hour reading that magazine!

Also, find out how much money you can keep aside to pay for your debt. Once you know this, you can try to save more money for the repayment every month.

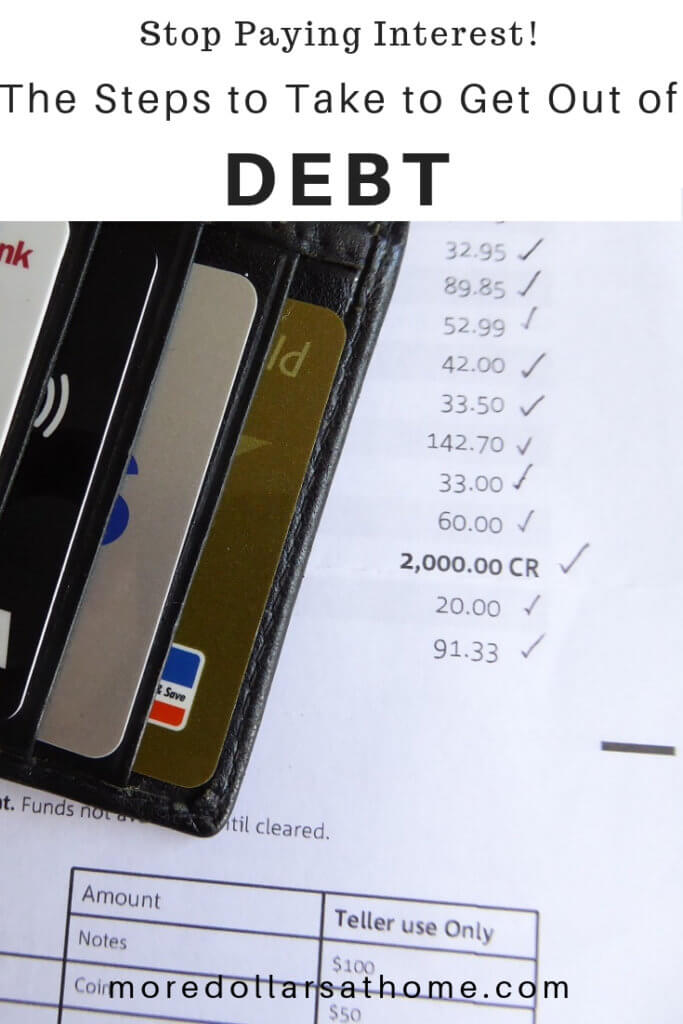

6. Figure Out What You Owe and Who You Owe it To

You need to know exactly how much you owe and who you owe it to. Take a piece of paper and write down all your debts.

Now, you have a clear idea how much you owe to whom. While writing down your debts, list each creditor, total balance, and the amount of money you can save monthly to repay them.

7. Start Repaying Your Debt

Once you have done all the paperwork, it is time to start the process of repaying your debt. In order to do so, prioritize your creditors.

Obviously, the first creditor you borrowed money from should be the first one getting his money back.

Make a list of these creditors and repay them by prioritizing them. This way, you will get rid of debt without a lot of debt burden.

8. Stick to the Repaying Habit

Once you start repaying your debts, you will feel more comfortable about managing your personal finance. Once you succeed in developing the habit of paying off your debts, make sure you stick to it.

Keeping yourself aligned with your debt elimination goals can be possible only if you continue the debt repayment process.

You can easily get out of debt if you have the willingness to do so. Although it requires extra effort to achieve the dream of living a debt-free life, it is highly rewarding. If you follow the above steps, you can definitely reduce debt quickly.

Want to stop living Paycheck to Paycheck? Here’s how!

Looking for more ways to reduce your debt?